HardManifest

MuscleHead

- Nov 21, 2022

- 286

- 266

pay up suckas. the libtards need their fix.

www.atr.org

www.atr.org

List of Biden Tax Hikes Hitting Americans on Jan. 1 - Americans for Tax Reform

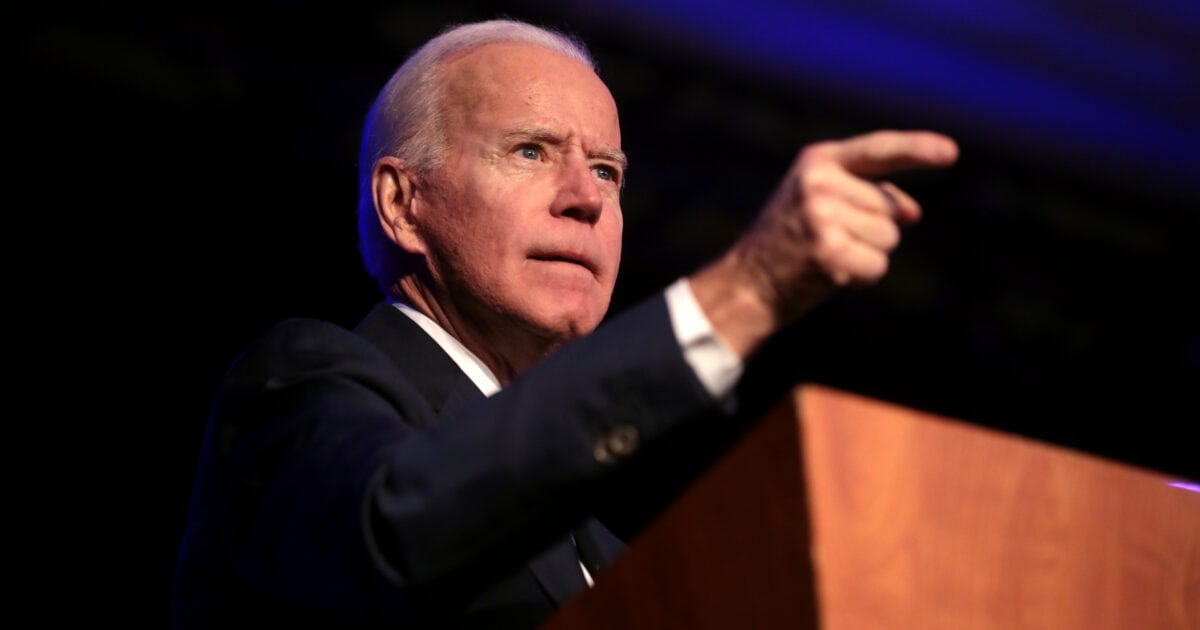

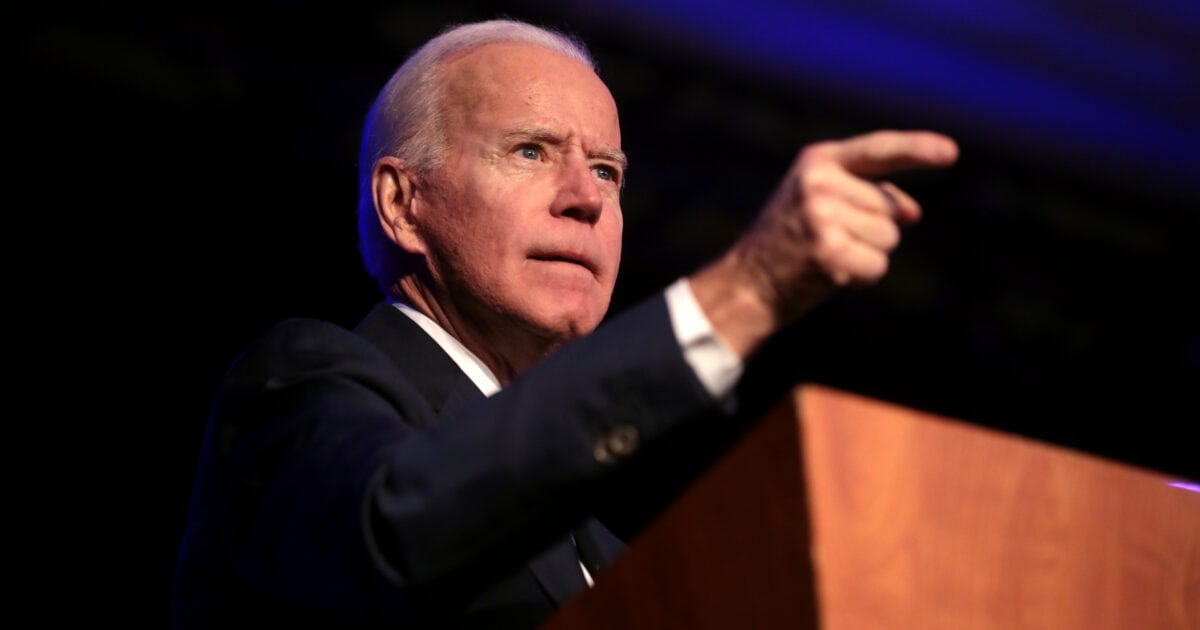

President Biden imposed a long list of tax hikes as part of the "Inflation Reduction Act." These Biden tax hikes take effect on Jan. 1: